Services > Business tax and audit support

Business tax and audit support

Tax shield services ensure accurate and compliant filings for businesses, covering income, credits, and deductions. Our expert tax preparers assist streamlines the process optimizing financial positions.

In the event of audit, our dedicated team provides audit support along with comprehensive guidance, ensuring businesses and also individual clients well-equipped to navigate the complexities and challenges of tax audits.

Why Choose Tax shield services for Business tax and audit support

Choosing tax shield services for your business taxes is a strategic decision for several reasons. We have 12+ years of experience when it comes to complex issues on business compliances and tax planning by providing specialized expertise to handle the intricacies of business taxation.

We specialize and provides expertise in business tax return services by ensuring accurate filings, maximizing deductions and credits. This ensures accurate, compliant filings, optimizing financial positions by identifying eligible deductions and credits specific to business operations.

In addition, the added benefit of audit support provides businesses and individual tax returns with a safety net, ensuring they have expert assistance and guidance in an event of a tax audit promoting financial security and compliance.

Cost of Business tax and audit support

The cost of business tax return services can vary based on various factors such as the complexity of the business structure, the level of service requires and the scope of financial activities. Usually, fees are influenced by the complexity of the business.

Additionally, factors of audit support and additional consultations might impact the overall cost of the preparation service. But the unique service in Tax shield is there is NO CHARGE for existing clients during a tax audit.

Services > Business tax and audit support

Business tax and audit support

Tax shield services ensure accurate and compliant filings for businesses, covering income, credits, and deductions. Our expert tax preparers assist streamlines the process optimizing financial positions.

In the event of audit, our dedicated team provides audit support along with comprehensive guidance, ensuring businesses and also individual clients well-equipped to navigate the complexities and challenges of tax audits.

Why Choose Business tax and audit support

Choosing tax shield services for your business taxes is a strategic decision for several reasons. We have 12+ years of experience when it comes to complex issues on business compliances and tax planning by providing specialized expertise to handle the intricacies of business taxation.

We specialize and provides expertise in business tax return services by ensuring accurate filings, maximizing deductions and credits. This ensures accurate, compliant filings, optimizing financial positions by identifying eligible deductions and credits specific to business operations.

In addition, the added benefit of audit support provides businesses and individual tax returns with a safety net, ensuring they have expert assistance and guidance in an event of a tax audit promoting financial security and compliance.

Cost of Business tax and audit support

The cost of business tax return services can vary based on various factors such as the complexity of the business structure, the level of service requires and the scope of financial activities. Usually, fees are influenced by the complexity of the business.

Additionally, factors of audit support and additional consultations might impact the overall cost of the preparation service. But the unique service in Tax shield is there is NO CHARGE for existing clients during a tax audit

Recent Business tax and audit support

Recent Business tax and audit support

Our Process For

Business tax and audit support

Step 1 Gather Financial Information

Collect and organize relevant financial information. This includes, income statements, expenses, receipts and any other necessary financial documents. This step ensures to utilize maximize eligible deductions and accurate reporting.

Step 2 Filling the right form

Filling the correct forms is crucial for accurate reporting. Common forms include Schedule C for sole proprietors and 1120 for corporations. provide the filled form to the tax preparer.

Our Process For Business tax and audit support

Step 1 Gather Financial Information

Collect and organize relevant financial information. This includes, income statements, expenses, receipts and any other necessary financial documents. This step ensures to utilize maximize eligible deductions and accurate reporting.

Step 2 Filling the right form

Filling the correct forms is crucial for accurate reporting. Common forms include Schedule C for sole proprietors and 1120 for corporations. provide the filled form to the tax preparer.

Taxshield Service Atlanta different Services

Things to Know About

Business tax and audit support

Precision in financial record-keeping: vital for deductions, compliance, and streamlined business tax preparation

Maintaining meticulous and well-organized financial records is the back bone of effective business tax preparation. These accurate records by tax clients play an immense role in guaranteeing adherence to the tax laws, pinpointing eligible deductions, and simplifying the overall filing process.

Leveraging experts or seeking experienced business tax professionals not only bolsters accuracy but also enhances efficiency ensuring that the business’s financial information is managed strategically and in accordance with regulatory requirements. This approach minimizes errors and facilitates a smoother business tax preparation process.

Knowing the business structure: Ensures proper compliance, maximizes benefits, and guides tax preparation decisions effectively.

To optimize potential tax benefits and ensure proper compliance, it is crucial for business tax clients to understand the distinct tax implications associated with different types of business structures (such as LLC, sole proprietorship, partnership, and corporation). Expert advice is invaluable in navigating the complex landscape of business tax preparation and minimizing the risk of oversights or errors.

Tax shield service has over 12 years of experience and helps promote financial health, strategic decision-making, and adherence to continuously evolving tax laws from tax authorities like the IRS. This allows taxpayers to tailor strategies and make business tax planning easier and faster.

Audit support: Guidance, document preparation, and expert representation, minimizing penalties and ensuring compliance.

Audit support is a service that helps individuals or businesses with tax audits. It gives professional advice and assistance to understand audit requests, prepare documents, and communicate with tax authorities. The service also helps organize and present financial records. Experts like Tax shield services can represent clients in audit meetings or correspondence with tax authorities (IRS).

The main goal is to minimize penalties and extra taxes during an audit. Our professional team can solve audit issues efficiently and get a good outcome for the taxpayer. This approach helps clients feel confident that experts are on their side and following tax rules. Overall, audit support is a valuable resource that provides expertise and guidance to successfully handle a tax audit for clients to have a peace of mind.

Costs associated with business taxes and audit support: Difference between new and existing clients

The cost of tax preparation services can be affected by additional features like audit support and extra consultations. These services help ensure a well-supported tax preparation process, but they can also increase expenses for individuals or businesses. Guiding clients through audits and providing extra consultations usually comes with certain fees for new clients.

One standout benefit offered by Tax Shield is that existing clients receive audit support at NO EXTRA CHARGE during a tax audit. This unique feature sets Tax Shield apart and gives clients financial peace of mind. This client friendly policy shows a commitment to client satisfaction and a focus on supporting clients during difficult times.

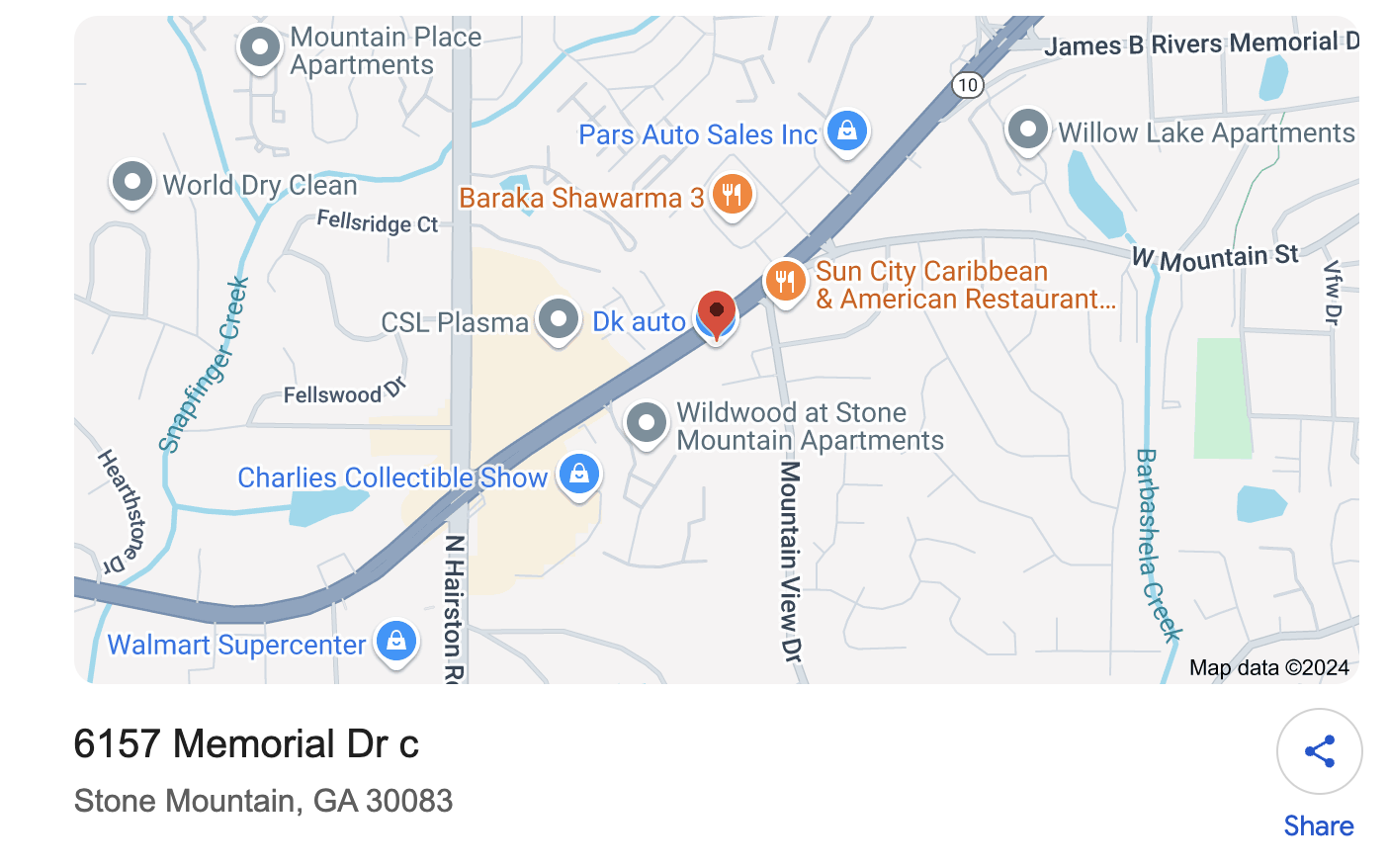

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Taxshield Service Atlanta Services

Things to Know About Business tax and audit support

Precision in financial record-keeping: vital for deductions, compliance, and streamlined business tax preparation

Maintaining meticulous and well-organized financial records is the back bone of effective business tax preparation. These accurate records by tax clients play an immense role in guaranteeing adherence to the tax laws, pinpointing eligible deductions, and simplifying the overall filing process.

Leveraging experts or seeking experienced business tax professionals not only bolsters accuracy but also enhances efficiency ensuring that the business’s financial information is managed strategically and in accordance with regulatory requirements. This approach minimizes errors and facilitates a smoother business tax preparation process

Knowing the business structure: Ensures proper compliance, maximizes benefits, and guides tax preparation decisions effectively.

To optimize potential tax benefits and ensure proper compliance, it is crucial for business tax clients to understand the distinct tax implications associated with different types of business structures (such as LLC, sole proprietorship, partnership, and corporation). Expert advice is invaluable in navigating the complex landscape of business tax preparation and minimizing the risk of oversights or errors.

Tax shield service has over 12 years of experience and helps promote financial health, strategic decision-making, and adherence to continuously evolving tax laws from tax authorities like the IRS. This allows taxpayers to tailor strategies and make business tax planning easier and faster.

Audit support: Guidance, document preparation, and expert representation, minimizing penalties and ensuring compliance.

Audit support is a service that helps individuals or businesses with tax audits. It gives professional advice and assistance to understand audit requests, prepare documents, and communicate with tax authorities. The service also helps organize and present financial records. Experts like Tax shield services can represent clients in audit meetings or correspondence with tax authorities (IRS).

The main goal is to minimize penalties and extra taxes during an audit. Our professional team can solve audit issues efficiently and get a good outcome for the taxpayer. This approach helps clients feel confident that experts are on their side and following tax rules. Overall, audit support is a valuable resource that provides expertise and guidance to successfully handle a tax audit for clients to have a peace of mind.

Costs associated with business taxes and audit support: Difference between new and existing clients

The cost of tax preparation services can be affected by additional features like audit support and extra consultations. These services help ensure a well-supported tax preparation process, but they can also increase expenses for individuals or businesses. Guiding clients through audits and providing extra consultations usually comes with certain fees for new clients.

One standout benefit offered by Tax Shield is that existing clients receive audit support at NO EXTRA CHARGE during a tax audit. This unique feature sets Tax Shield apart and gives clients financial peace of mind. This client friendly policy shows a commitment to client satisfaction and a focus on supporting clients during difficult times.

470-688-1040

Service Hours

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Social Media