A Guide for Tax service and advances

Basics on tax advance?

A Tax advance is basically one of the financial products that allows tax clients to receive a portion amount from your total refund. Tax refund advances are commonly available through various tax preparation services. This is beneficial for those who want early access to their funds.

Accessing various types of Advances: Holiday and Refund Advances

Different income tax preparation services have various products like holiday and refund advances depending on their services. It’s beneficial contacting different tax places about their products and comparing their services.

Holiday advances also known as Christmas advances are available in some tax places during the month of December and early January. Holiday advances are very beneficial for tax clients as it covers and gives a financial break for the holiday expenses. These convenient advance provide tax payers with quick access to funds, catering to different timelines in the tax return process, ensuring flexibility and financial support during various stages of the tax preparation process.

Life is full of unexpected expenses and opportunities that require immediate financial resources. Whether it's covering medical bills, home repairs, or other, having early access to funds can make all the difference.

Receiving a tax advance as an individual taxpayer brings the notable advantage of accessing your hard-earned money promptly as an individual taxpayer. Holiday advances provide momentous advantage for tax clients - flexibility. Whether you prefer to receive your funds via direct deposit, a prepaid card, or even as a check, tax providers typically offer various options to suit your needs. This level of convenience allows you to access your money in a way that works best for you.

Refund advances are also beneficial for small business clients that pays self-employment taxes. A tax advance can provide the essential funds needed to cover expenses such as inventory purchases, marketing initiatives and other unexpected expenses during the holiday. A Refund advance offers an opportunity to bridge these gaps by providing access to funds when they're most needed. By utilizing a tax advance wisely, small businesses can seize opportunities that arise throughout the year without having to wait till the tax season is over.

Small businesses such as hair stylists, nail salons, child care, barbers, land-scaping, baby sitters, masonry, etc. experience seasonal fluctuations in revenue and cash flow. If your business relies heavily on certain times of the year for sales (e.g., holiday shopping seasons), managing cash flow during slower periods can be challenging. Having an infusion of cash through a tax refund advance can help keep your business running smoothly year-round.

Pre-qualification for Tax advance loans

Tax Refund Advance is a loan provided at participating income Tax preparation Service locations. Tax clients could get up to $7,500 tax refund loan after filing their taxes and depending on their criteria and various qualifications.

The applications in most tax places are simple and straightforward. Tax clients should bring their W-2, 1099s, Income and expense breakdowns (for self-employment) and all other necessary documents required by the tax authorities, and apply to participating tax pros for pre-qualification.

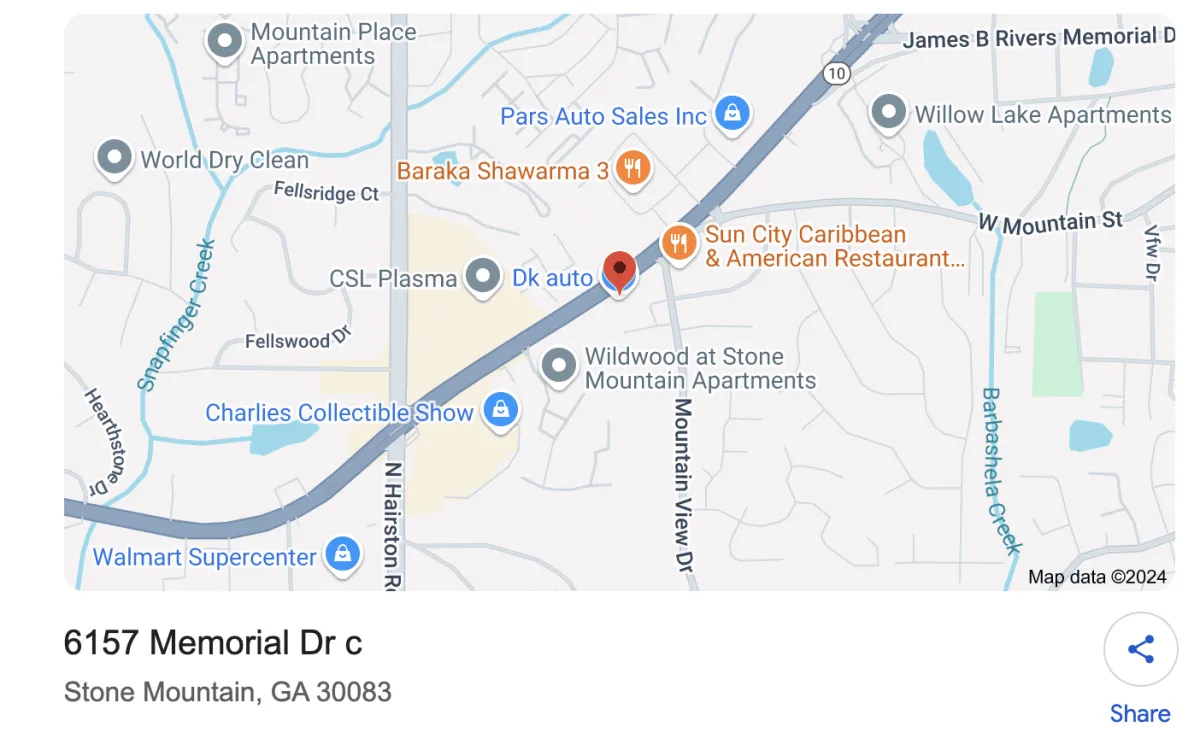

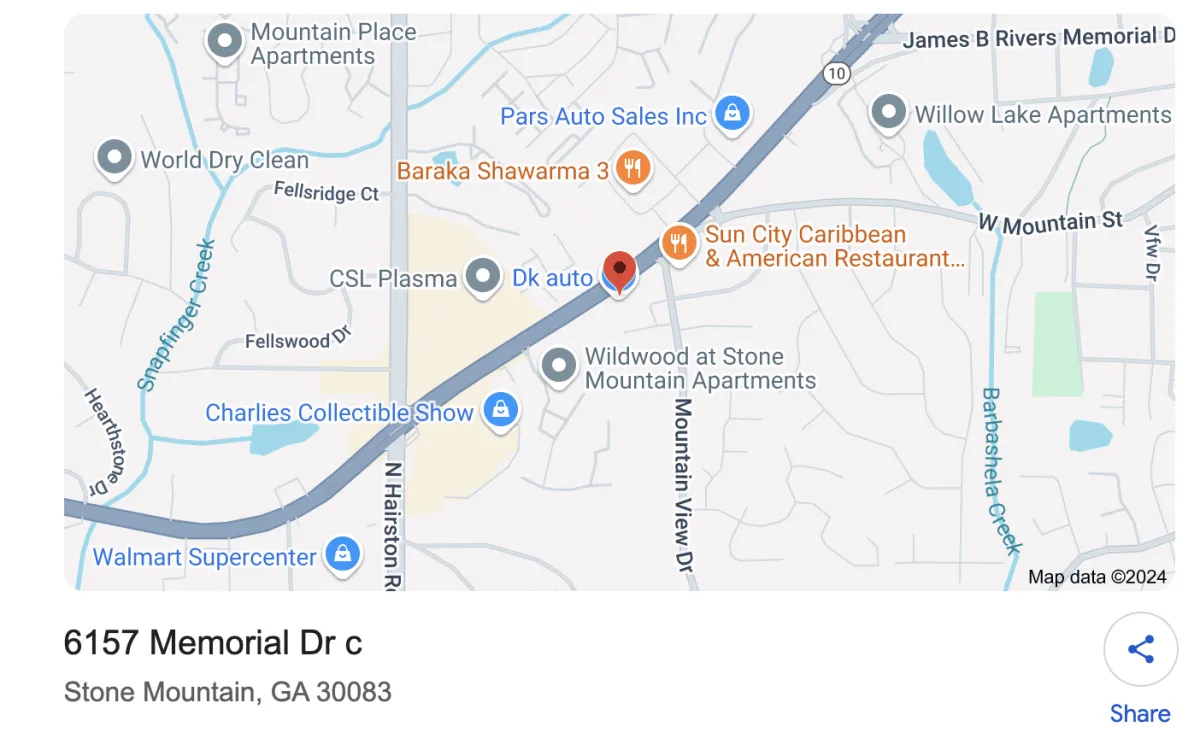

Contact us to qualify for a tax advance loan

Qualifications, criteria and things to know about Tax refund advances

We've all encountered those enticing promotions, deals and discounts with limited time offers that seem too good to pass up. Usually, advances like tax advances, tax loans, refund advances, Christmas advances, and refund loans come with expiration dates that sometimes don't align with our refund schedules. With these different advances at your disposal, opportunities slip away due to timing constraints. Accessing these funds allows you to take advantage of these time-sensitive deals.

With the evolving advancement of technology in developing apps and user-friendly sites most tax offices offer an online application from the comfort of your home of work office. This saves you valuable time into your busy schedule.

Qualifying for refund advances characteristically requires fulfilling certain eligibility criteria. Navigating, the eligibility and approval process for these advances entails several factors, with specific requirements varying based on the taxpayer's documentation and information. Common considerations encompass crucial documents with no credit check, consistent income, history of timely tax filings and a valid social security number. The qualifications and criteria vary among different tax preparation offices, but usually applicants must demonstrate their ability to repay the advance.

Upon qualification, tax clients gain the flexibility on how they receive their funds via check, direct-deposit, pre-paid cards, etc. to utilize the funds according to their financial needs. This allows majority of tax individuals to use their approved funds instantly.

Planning in using holiday advances wisely is essential. First, assess your financial situation if the advance aligns with your specific needs. Be aware of any conditions or restrictions set by the tax preparers and tax offices. It is highly recommended to avoid surprises by considering various factors. Advances on taxes need to be repaid with their associated fees depending on various tax firms when the whole tax refund is issued by the IRS.

Understanding the repayment process of the different types of advances is vital. Advances on taxes need to be repaid with their associated fees depending on various tax firms when the whole tax refund is issued by the IRS.

Various tax firms have different fee structures and other associated fees depending on the products they offer in different states. It’s highly recommended to search for tax providers and offices that distinguishes their fee structure, offering a cost-free option or charges with low amount. In contrast from the Christmas advances, refund advance after the holidays typically come with certain bank fees, depending on the advance amount. Ask your tax preparer to provide you with all the information.

Tax preparers are obligated to disclose all relevant information to clients regarding specific fees before proceeding with the processing of your returns

This blog post explored the benefits, qualifications, criteria and things to know about tax advance. I hope, this article shed light by educating most tax clients providing financial planning in their specific needs and empower tax individuals in utilizing your hard-earned money. Tune in for more information by following us.

A Guide for Tax service and advances

Basics on tax advance?

A Tax advance is basically one of the financial products that allows tax clients to receive a portion amount from your total refund. Tax refund advances are commonly available through various tax preparation services. This is beneficial for those who want early access to their funds.

Accessing various types of Advances: Holiday and Refund Advances

Different income tax preparation services have various products like holiday and refund advances depending on their services. It’s beneficial contacting different tax places about their products and comparing their services.

Holiday advances also known as Christmas advances are available in some tax places during the month of December and early January. Holiday advances are very beneficial for tax clients as it covers and gives a financial break for the holiday expenses. These convenient advance provide tax payers with quick access to funds, catering to different timelines in the tax return process, ensuring flexibility and financial support during various stages of the tax preparation process.

Life is full of unexpected expenses and opportunities that require immediate financial resources. Whether it's covering medical bills, home repairs, or other, having early access to funds can make all the difference.

Tax service

Receiving a tax advance as an individual taxpayer brings the notable advantage of accessing your hard-earned money promptly as an individual taxpayer. Holiday advances provide momentous advantage for tax clients - flexibility. Whether you prefer to receive your funds via direct deposit, a prepaid card, or even as a check, tax providers typically offer various options to suit your needs. This level of convenience allows you to access your money in a way that works best for you.

Refund advances are also beneficial for small business clients that pays self-employment taxes. A tax advance can provide the essential funds needed to cover expenses such as inventory purchases, marketing initiatives and other unexpected expenses during the holiday. A Refund advance offers an opportunity to bridge these gaps by providing access to funds when they're most needed. By utilizing a tax advance wisely, small businesses can seize opportunities that arise throughout the year without having to wait till the tax season is over.

Small businesses such as hair stylists, nail salons, child care, barbers, land-scaping, baby sitters, masonry, etc. experience seasonal fluctuations in revenue and cash flow. If your business relies heavily on certain times of the year for sales (e.g., holiday shopping seasons), managing cash flow during slower periods can be challenging. Having an infusion of cash through a tax refund advance can help keep your business running smoothly year-round.

Pre-qualification for Tax advance loans

Tax Refund Advance is a loan provided at participating income Tax preparation Service locations. Tax clients could get up to $7,500 tax refund loan after filing their taxes and depending on their criteria and various qualifications.

The applications in most tax places are simple and straightforward. Tax clients should bring their W-2, 1099s, Income and expense breakdowns (for self-employment) and all other necessary documents required by the tax authorities, and apply to participating tax pros for pre-qualification.

Qualifications, criteria and things to know about Tax refund advances

We've all encountered those enticing promotions, deals and discounts with limited time offers that seem too good to pass up. Usually, advances like tax advances, tax loans, refund advances, Christmas advances, and refund loans come with expiration dates that sometimes don't align with our refund schedules. With these different advances at your disposal, opportunities slip away due to timing constraints. Accessing these funds allows you to take advantage of these time-sensitive deals.

Tax service and advances

With the evolving advancement of technology in developing apps and user-friendly sites most tax offices offer an online application from the comfort of your home of work office. This saves you valuable time into your busy schedule.

Qualifying for refund advances characteristically requires fulfilling certain eligibility criteria. Navigating, the eligibility and approval process for these advances entails several factors, with specific requirements varying based on the taxpayer's documentation and information. Common considerations encompass crucial documents with no credit check, consistent income, history of timely tax filings and a valid social security number. The qualifications and criteria vary among different tax preparation offices, but usually applicants must demonstrate their ability to repay the advance.

Upon qualification, tax clients gain the flexibility on how they receive their funds via check, direct-deposit, pre-paid cards, etc. to utilize the funds according to their financial needs. This allows majority of tax individuals to use their approved funds instantly.

Planning in using holiday advances wisely is essential. First, assess your financial situation if the advance aligns with your specific needs. Be aware of any conditions or restrictions set by the tax preparers and tax offices. It is highly recommended to avoid surprises by considering various factors. Advances on taxes need to be repaid with their associated fees depending on various tax firms when the whole tax refund is issued by the IRS.

Understanding the repayment process of the different types of advances is vital. Advances on taxes need to be repaid with their associated fees depending on various tax firms when the whole tax refund is issued by the IRS.

Various tax firms have different fee structures and other associated fees depending on the products they offer in different states. It’s highly recommended to search for tax providers and offices that distinguishes their fee structure, offering a cost-free option or charges with low amount. In contrast from the Christmas advances, refund advance after the holidays typically come with certain bank fees, depending on the advance amount. Ask your tax preparer to provide you with all the information.

Tax preparers are obligated to disclose all relevant information to clients regarding specific fees before proceeding with the processing of your returns

This blog post explored the benefits, qualifications, criteria and things to know about tax advance. I hope, this article shed light by educating most tax clients providing financial planning in their specific needs and empower tax individuals in utilizing your hard-earned money. Tune in for more information by following us.

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

470-688-1040

Service Hours

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

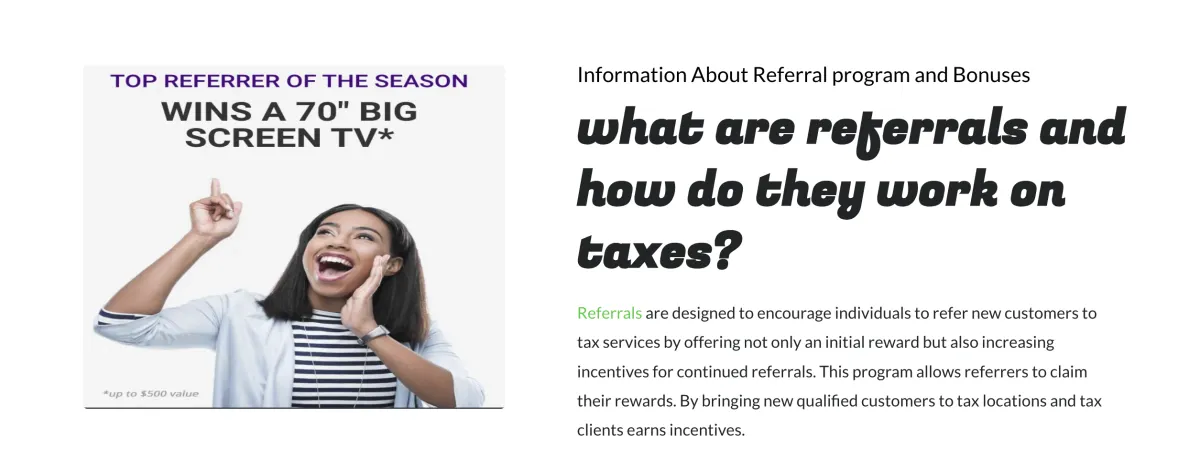

Social Media